Jackson Township Property Values to Rise 13% in 2025 Assessment

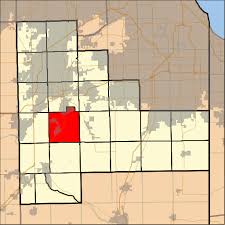

Jackson Township property owners will see assessed values increase by 13.18% in the upcoming assessment cycle, Assessor LeGrett reported at the township’s January 8 monthly meeting.

The increase, which will affect 2025 property values and appear on 2026 tax bills, reflects broader county-wide trends. Will County as a whole is experiencing a 13.92% assessment increase, making Jackson Township’s rate slightly below the county average.

“We got our tentative factor for 2025 and the County as a whole is looking at a 13.92% increase and Jackson Township is looking at 13.18% increase,” LeGrett told the township board. “These will be 2025 values and 2026 tax bills.”

The assessment increase comes as property values continue rising across Will County following several years of robust real estate market activity. The new assessments will be used to calculate property tax bills that residents receive in 2026.

Property tax assessments are conducted annually by township assessors and reviewed by the Will County Board of Review. The tentative factors announced at the meeting represent preliminary calculations that may be adjusted during the county’s review process.

Township officials approved LeGrett’s 2025 budget during the meeting, with trustees unanimously supporting the assessor’s spending plan that was initially presented in December 2024.

The township board consists of Supervisor Matt Robbins, Clerk Kathryn Hunt, Highway Commissioner Walsh, and trustees Jake Fanning, Michele Hallihan, Norm Fanning, and Coley O’Connell. Attorney John Gallo also attended the January meeting.

Jackson Township’s next monthly meeting is scheduled for Wednesday, February 12 at 6:30 p.m. at Jackson Township Hall.

Community Events

Latest News Stories

Report: Illinois U.S. Rep faces minimal penalty after disclosure violations

18 were injured, 2 killed in Minneapolis shooting

Trump HHS tells states to remove gender ideology from sex ed or lose PREP funding

Americans could face ‘sticker shock’ as once-small tax exemption ends

‘Pro-taxpayer’ law requires operators to clean up abandoned Illinois oil wells

Watch: Cook County gun ban plaintiffs petition SCOTUS; Pritzker hasn’t heard from White House

Illinois quick hits: Man on pretrial release accused of murder; holiday weekend impaired driving patrols

Illinois quick hits: Gun ban challengers petition SCOTUS; man sentenced for COVID fraud

WATCH: Trump: Illinois’ ‘slob of a governor’ should call for help with public safety

WATCH: Legislator says Illinois’ child welfare agency uses interns, has legal exposure

Economic index shows reduced uncertainty, more stability in Midwest

New law sparks debate over Illinois school mergers, communities fear loss