Manhattan to Enact Local 1% Grocery Tax, Replacing State Revenue Stream

MANHATTAN – The Village of Manhattan will implement a 1% local grocery tax beginning January 1, 2026, a move designed to preserve a crucial revenue stream after the State of Illinois voted to repeal its own 1% tax on groceries.

The Village Board approved the ordinance in a 5-1 vote Tuesday, with Trustee Clint Boone voting against the measure. Village officials stressed that the ordinance does not create a new tax for consumers but simply shifts the collection authority from the state to the municipality, ensuring no net change at the checkout counter.

“This is not a new tax,” Mayor Mike Adrieansen explained during the meeting. “Currently the state collects this 1% grocery tax and distributes it all to the municipalities. So starting in 2026, the state will no longer collect this tax and it’ll be up to the municipalities to collect it ourselves.”

The state’s repeal of the grocery tax was part of its Fiscal Year 2025 budget. The legislation, however, granted municipalities the authority to impose their own 1% tax to avoid a loss of funding. Like many other local governments across Will County and Illinois, Manhattan is taking this preemptive step to maintain its budget.

Trustee Justin Young sought to clarify the impact on residents. “I just want to make sure that the people in this village aren’t paying any more than what they have to,” he said.

Adrieansen agreed, framing the state’s action as a political maneuver. “If they wanted to help, the state could lower property tax or fund the schools more,” he said.

The tax applies to qualifying food and beverage items typically consumed off-premises, such as produce, dairy, and meat, but does not apply to prepared foods like a hot pizza or chicken. As with the state tax, purchases made with SNAP or LINK cards are exempt.

The Illinois Department of Revenue will continue to administer and collect the tax on behalf of the village. The village is required to file the ordinance with the department before October 1, 2025, for the tax to take effect at the beginning of 2026. While the exact annual revenue from the tax is confidential, officials estimate it to be a significant figure for the village budget.

Latest News Stories

Manhattan Awards $537,907 Contract for Hanover Estates Road Resurfacing

WATCH: Illinois State Fair: Affordable fun backed by $140M in taxpayer funding

Op-Ed: State lawmakers gut Emmett Till Day bill, expose Illinois’ corruption problem

Democratic PACs being investigated for bankrolling AWOL Texas House Democrats

Pritzker: Chicago mayor ‘never once called’ to oppose pension bill

WATCH: Illinois In Focus Daily | Thursday Aug. 7th, 2025

Illinois quick hits: Cook County declares flood disaster; opt-out forms promoted; State Fair begins

Manhattan to Enact Local 1% Grocery Tax, Replacing State Revenue Stream

Manhattan Hires New Full-Time Accountant Amid Village Growth

WATCH: IL Republican pushes for TX quorum rules that Pritzker hails as ‘hero’ move

Manhattan Police Report

Indiana Woman Identified as Victim in Fatal Wilmington-Peotone Road Crash

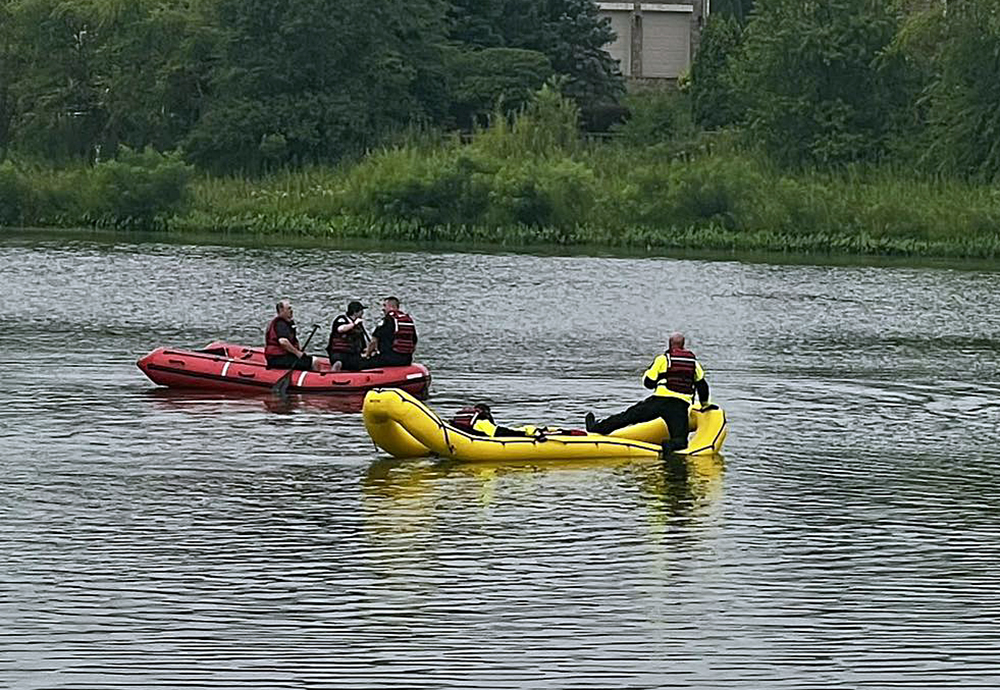

Multiple Agencies Rescue Person in Mental Health Crisis from Frankfort Pond

Green Garden Township Forges Ahead with New Town Hall Plan, Faces Budget and Neighbor Concerns