Manhattan Township Seniors Could Benefit from Proposed State Property Tax Relief

Manhattan Township Meeting | August 2025

Article Summary: More senior citizens in Manhattan Township may soon qualify for property tax relief, as Assessor Joe Oldani reported that state legislation is pending to significantly increase the income eligibility limit for the Senior Citizen Assessment Freeze Homestead Exemption. The change would raise the income ceiling from $65,000 to nearly $80,000 over several years.

Senior Freeze Exemption Key Points:

-

A pending state law would increase the maximum income for the Senior Freeze Exemption.

-

The income ceiling would rise incrementally from the current $65,000 to a final cap of $79,000.

-

The assessor also reported that Manhattan Township will not receive a final assessment factor, or multiplier, from Will County for 2025.

Senior homeowners in Manhattan Township may soon get a break on their property tax bills, the Township Board learned on Tuesday, August 12, 2025.

During his monthly report, Township Assessor Joe Oldani announced that a state law is pending that would raise the income threshold for the Senior Citizen Assessment Freeze Homestead Exemption. This program allows qualified seniors to “freeze” the equalized assessed value (EAV) of their homes, protecting them from increases due to inflation or rising property values.

Currently, the maximum household income to qualify is $65,000. Oldani reported the new legislation would raise that ceiling incrementally over several years, starting at $75,000 and eventually capping out at $79,000. This change would allow more seniors on fixed incomes to qualify for the tax relief program.

In other assessment news, Oldani informed the board that the Will County Supervisor of Assessments Office will not be applying an increased final assessment factor to Manhattan Township for 2025. The lack of a township-wide multiplier means property assessments will not see a blanket increase from the county this year.

Community Events

Latest News Stories

Will County Public Works Committee Unveils 25-Year Transportation Plan, Projects $258 Million Gap

Will County Animal Protection Services Seeks New Facility Amid “Gaping Wound” of Space Crisis

Board Confronts Animal Services Crowding, Explores Future Facility Options

Will County Board Members Demand Transparency in Cannabis Tax Fund Allocation

Homer Glenn Residents Push Back on 143rd Street Widening as Officials Signal “Tentative Agreement”

Will County Forges 2026 Federal Agenda Amid D.C. Policy Shifts, ‘Big Beautiful Bill’ Impacts

Health Department Seeks $1 Million Levy Increase to Prevent “Weakened System”

County Rolls Out New “OneMeeting” Software to Improve Public Access

Meeting Summary and Briefs: Will County Board Finance Committee for August 5, 2025

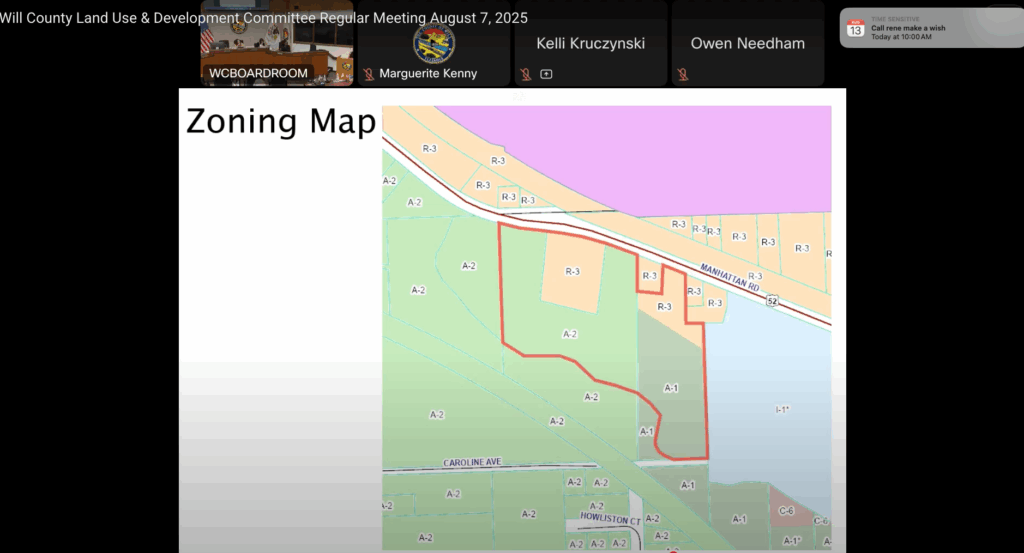

Will County PZC Approves Rezoning for Truck Repair Facility on Manhattan Road Amid Resident Concerns

Key Stretch of Bell Road on Track for Thanksgiving Reopening, Committee Approves Additional Funds

Will County Leglislative Committee Opposes Federal Push for Heavier, Longer Trucks

Will County Reports Progress in Opioid Fight, Highlights New FDA Labeling Rules