Chicago’s commercial property taxes spike to twice national city average

(The Center Square) – Chicago business owners are now being forced to pay some of the highest commercial property taxes in the country at more than 4% of their properties value, or more than double the national average of 1.81%.

The sobering numbers are highlighted in a new Lincoln Institute of Land Policy study that also outlines how the rising rates are taking a toll on the city across the board, including leading to fewer overall businesses and growing inequalities in various communities.

Illinois Policy Institute’s Dylan Sharkey is among those taking notice.

“Chicago has incredibly high commercial property taxes even compared to other big cities and pensions are one of the biggest reasons,” Sharkey told The Center Square. “This puts the city one big step closer to insolvency, to bankruptcy, and the state is going to be on the hook for that if that day ever comes.”

While some worry the persistent struggle could leave the city in the same place as Detroit when that city became insolvent, Sharkey said the situation here at home is much worse.

“When Detroit went bankrupt, Michigan as a state wasn’t broke,” he said. “Illinois as a state is broke. It’s like a father and son going bankrupt together. The head of the household in Michigan was able to help out with the money. Illinois doesn’t have that type of money to give out because the state is also broke.”

As the city’s struggles have lingered, Sharkey said he wouldn’t be surprised to see Chicago Mayor Brandon Johnson resort to pushing a measure similar to the $300 million property tax hike he introduced last year as part of the city’s budget before it was unanimously rejected by the Chicago City Council.

“It was the first time ever where you had all 50 council members voting no on something from the Mayor for property tax hikes,” he said. “I wouldn’t be surprised if he tries something like that again, given this new $11 billion in pension debt and Chicago’s budget shortfall.”

Gov. J.B. Pritzker recently signed legislation enhancing the pensions for Tier II police and firefighters in Chicago, a move Johnson said was “incomplete” without more tax dollars going to the city.

Latest News Stories

Meeting Summary and Briefs: Manhattan School District 114 for October 8, 2025

Meeting Summary and Briefs: Village of Manhattan for October 7, 2025

Regional Office of Education Highlights School Safety, New Learning Programs in Update

Lincoln-Way to Purchase New Buses, Add Smaller Vehicles to Address Driver Shortage

Will County Awards $10.4 Million Contract for Bell Road Widening Project

Green Garden’s Wildflower Farm Granted Second Extension for Rural Events Permit

Manhattan Seeks $250,000 State Grant for Safe Routes to School Program

Will County Board Compromises on Mental Health Levy, Approves $10 Million After Debate

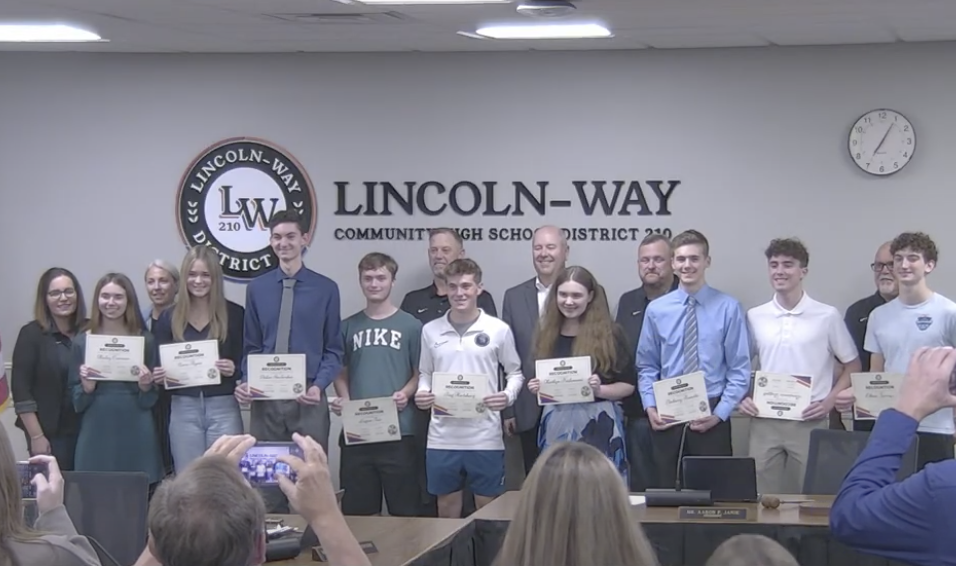

Lincoln-Way Board Honors Students with Perfect ACT Scores, Music Educator of the Year

Manhattan 114 Reviews Fall Student Benchmark Data, Sees Strong Growth

Public Hearing for 41-Home Butternut Ridge South Subdivision Continued in Manhattan

Will County Board Rejects Proposed Tax Hike, Approves 0% Levy Increase in Contentious Vote