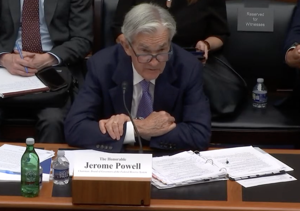

Dow hits record high after Fed Chair hints at September rate cuts

The Dow Jones Industrial Average clinched a record high Friday for the first time this year hours after Federal Reserve Chair Jerome Powell hinted that the Fed may soon lower interest rates.

The Dow climbed 846 points, or 1.89%, from Thursday’s close to an all-time high of 45,631.74.

Both the broadly diversified S&P 500 and the tech-heavy Nasdaq have recorded more than 15 record highs in 2025.

Investors across the country watched Powell’s live streamed address at an economic symposium in Jackson Hole, Wyo., Friday, where he described the economic conditions facing Americans and the Fed. The data indicate that rising inflation and weakening employment are more likely than not, according to Powell, creating a “challenging situation.”

“When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate,” which he explained as “[fostering] maximum employment and stable prices for the American people.”

A moment later, however, after mentioning some positives about America’s current economic state, he still suggested that a review of the Fed’s policy stance – which hasn’t lowered interest rates since December – was in order.

“Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” he said.

Observers have taken Powell’s remarks to mean the central bank is looking at reducing interest rates at its September meeting, which the Fed would typically do to stimulate a slowing economy.

Lower interest rates encourage more spending and more borrowing, which can boost corporate profits and investor confidence, often supporting stock market growth.

President Donald Trump has been pressuring Powell to lower rates for months, yet Powell assured listeners Friday that if the Fed does lower interest rates, it will be because it is their best decision based on the data and not because of political pressure.

The members of the Federal Open Market Committee will “make these decisions based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach,” he said.

Latest News Stories

Jackson Township Property Values to Rise 13% in 2025 Assessment

Jackson Township Advances Infrastructure Projects Despite Winter Conditions

Jackson Township Meeting Briefs

- « Previous

- 1

- …

- 62

- 63

- 64