Everyday Economics: Softer tape, PCE in focus, and the Fed’s next move

This summer, economic signals leaned softer. Hiring looks frozen, retail sales volumes are flat to slightly negative, and existing-home sales are essentially unchanged from a year ago. Housing starts are roughly flat year over year, while permits are below year-ago levels – an early sign that construction employment could slip further as future supply slows.

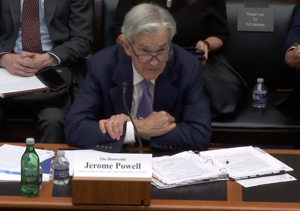

Last week, the main event was Fed Chair Jerome Powell’s Jackson Hole address. He acknowledged a softer labor backdrop and reaffirmed that policy remains restrictive – guidance markets read as a green light for a September cut. Fed-funds futures lifted the odds of a September move into the mid-to-high-80s (from the low-70s pre-speech). Bonds rallied: the 10-year Treasury yield fell about 7 bps, and mortgage rates eased roughly 10 bps. Futures now imply several additional cuts through mid-2026 – about 125 bps in total.

Up next: Friday’s Personal Income & Outlays report, including the Fed’s preferred inflation gauge – the personal consumption expenditures (PCE) price index. Last month, headline and core PCE each rose 0.3% month over month; headline accelerated to 2.6% year over year and core held at 2.8% year over year. Inflation has been accelerating since April when it stood at just 2.2% – a hair above the Fed’s target. The question now is whether inflation momentum cools enough to justify a September cut.

What I’m watching this week:

Prices. If core PCE cools back toward 0.2% month over month, September cut odds likely firm up; another 0.3% or higher could trim those odds at the margin.Real demand. Real PCE and real disposable income. A downshift would reinforce the “stall-speed” narrative for private hiring – without inviting a wage-price spiral. Higher prices would reduce real incomes, lower consumer spending and slow the economy further.Services vs. goods. Services inflation has been the sticky piece in PCE; any moderation would be a welcome sign for the Fed.

Housing gets a fresh read from new home sales. Consensus looks for a slight increase. Mortgage rates have drifted lower since May, and builders continue to meet the market with price cuts and incentives. At the same time, the flow of resale listings is falling again, which helps channel demand toward new construction. That mix – incrementally lower rates, more concessions, and the fact that resale inventory hasn’t increased further – should support new-home sales even as overall housing activity remains somewhat subdued.

Bottom line: The Fed has opened the door to a September cut, and markets mostly walked through it. The PCE report will determine whether those odds stay high. Even with a cut, don’t expect mortgage rates to plunge: much of the expected easing into 2026 is already priced in, pointing to a gradual drift lower rather than a step-function decline.

Latest News Stories

Illinois patient relies on ACA tax credits, experts warn they drive higher premiums

Trump rolls back tariffs on over 200 foods in sharp reversal

Trump says $2,000 tariff rebate checks won’t come before Christmas

Chicago mayor threatens layoffs, property tax hikes if council rejects head tax

Goldwater Institute sues Arizona attorney general for records

Illinois quick hits: Four officers injured during ICE protest

California asks court to end federalization of National Guard

Manhattan D114 Projects Flat Tax Rate Despite Higher Levy Request, Plans Abatement

ICE, Florida officers arrest 230, including 150 sex offenders

With shutdown over, fight over Obamacare reform is on

Feds launch initiative to conduct welfare checks on unaccompanied minors

Will County Committee Denies Appeal for Crete Township ‘Tiny Home’ Permit

Judge: Biden-era decree deal requires release of 600+ from ICE detention

Poll: Majority believe free speech in U.S. headed in wrong direction