Everyday Economics: Softer tape, PCE in focus, and the Fed’s next move

This summer, economic signals leaned softer. Hiring looks frozen, retail sales volumes are flat to slightly negative, and existing-home sales are essentially unchanged from a year ago. Housing starts are roughly flat year over year, while permits are below year-ago levels – an early sign that construction employment could slip further as future supply slows.

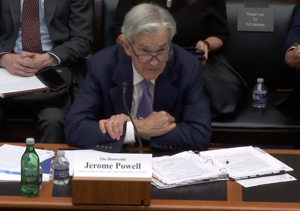

Last week, the main event was Fed Chair Jerome Powell’s Jackson Hole address. He acknowledged a softer labor backdrop and reaffirmed that policy remains restrictive – guidance markets read as a green light for a September cut. Fed-funds futures lifted the odds of a September move into the mid-to-high-80s (from the low-70s pre-speech). Bonds rallied: the 10-year Treasury yield fell about 7 bps, and mortgage rates eased roughly 10 bps. Futures now imply several additional cuts through mid-2026 – about 125 bps in total.

Up next: Friday’s Personal Income & Outlays report, including the Fed’s preferred inflation gauge – the personal consumption expenditures (PCE) price index. Last month, headline and core PCE each rose 0.3% month over month; headline accelerated to 2.6% year over year and core held at 2.8% year over year. Inflation has been accelerating since April when it stood at just 2.2% – a hair above the Fed’s target. The question now is whether inflation momentum cools enough to justify a September cut.

What I’m watching this week:

Prices. If core PCE cools back toward 0.2% month over month, September cut odds likely firm up; another 0.3% or higher could trim those odds at the margin.Real demand. Real PCE and real disposable income. A downshift would reinforce the “stall-speed” narrative for private hiring – without inviting a wage-price spiral. Higher prices would reduce real incomes, lower consumer spending and slow the economy further.Services vs. goods. Services inflation has been the sticky piece in PCE; any moderation would be a welcome sign for the Fed.

Housing gets a fresh read from new home sales. Consensus looks for a slight increase. Mortgage rates have drifted lower since May, and builders continue to meet the market with price cuts and incentives. At the same time, the flow of resale listings is falling again, which helps channel demand toward new construction. That mix – incrementally lower rates, more concessions, and the fact that resale inventory hasn’t increased further – should support new-home sales even as overall housing activity remains somewhat subdued.

Bottom line: The Fed has opened the door to a September cut, and markets mostly walked through it. The PCE report will determine whether those odds stay high. Even with a cut, don’t expect mortgage rates to plunge: much of the expected easing into 2026 is already priced in, pointing to a gradual drift lower rather than a step-function decline.

Latest News Stories

Park District Awards Eight Scholarships to Lincoln-Way East Seniors

Transportation Projects Advance as Board Approves Vision Zero, Road Improvements

Health Department Receives Budget Boost, Sunny Hill Admission Policy Updated

Meeting Briefs: Frankfort Square Park District for May 15, 2025

Lincoln Way District 210 Achieves Highest Bond Rating in History

District Recognizes Outstanding Student Readers in Statewide Program

Board Meeting Shorts

Student Council Presidents Highlight Senior Year Accomplishments

Will County Board Meeting Briefs Package

Manhattan Police Reports

Manhattan District Adopts New Math Program After Comprehensive Review

Manhattan Junior High Scholastic Bowl Team Places Second at State Championship