Guidelines issued on how taxpayers can claim deductions on tips, overtime in 2025

Millions of Americans who work overtime shifts or receive tips will be eligible to claim new deductions on their 2025 tax returns, the Trump administration announced Friday.

Republicans’ budget reconciliation bill, which became law in July, created temporary tax deductions for tips and overtime compensation, applying to single filers making up to $150,000 annually and joint filers making up to $300,000 annually.

Tipped workers can claim a maximum deduction of $25,000. An estimated 6 million Americans are eligible for this deduction, according to guidelines released by the Treasury Department and Internal Revenue Service.

The deduction for overtime compensation maxes out at $15,000 for single filers and $25,000 for joint filers.

Although polls show the deductions are politically popular – President Donald Trump made “No Tax on Tips” a slogan in his 2024 election campaign – they are also expensive.

The mammoth budget reconciliation bill cost trillions of dollars, mostly due to lost revenue from the massive tax cuts it included. The national debt topped $38 trillion this year, just months after hitting $37 trillion.

Besides the new tips and overtime deductions, set to expire in four years, the bill codified the 2017 Tax Cuts and Jobs Act’s $15,000 maximum standard deduction and boosted the child tax credit to $2,200 permanently.

The average American household will benefit from the combined tax cuts, the Congressional Budget Office estimates, though the impacts will vary by income levels.

Middle class and upper class Americans will benefit most from these tax changes. Households in the middle of the income distribution, or the fifth and sixth tax brackets, will see their resources increase anywhere from $800 to $1,200 annually. Households in the highest tax bracket will see their resources increase about $13,600 annually, roughly 2.7% of their income.

Community Events

Latest News Stories

Trump to probe Smithsonian museums for ‘woke’ ideology

Director: Nation’s largest outdoor ag show brings economic impact to central IL

NY appeals court overturns Trump’s civil fraud penalty

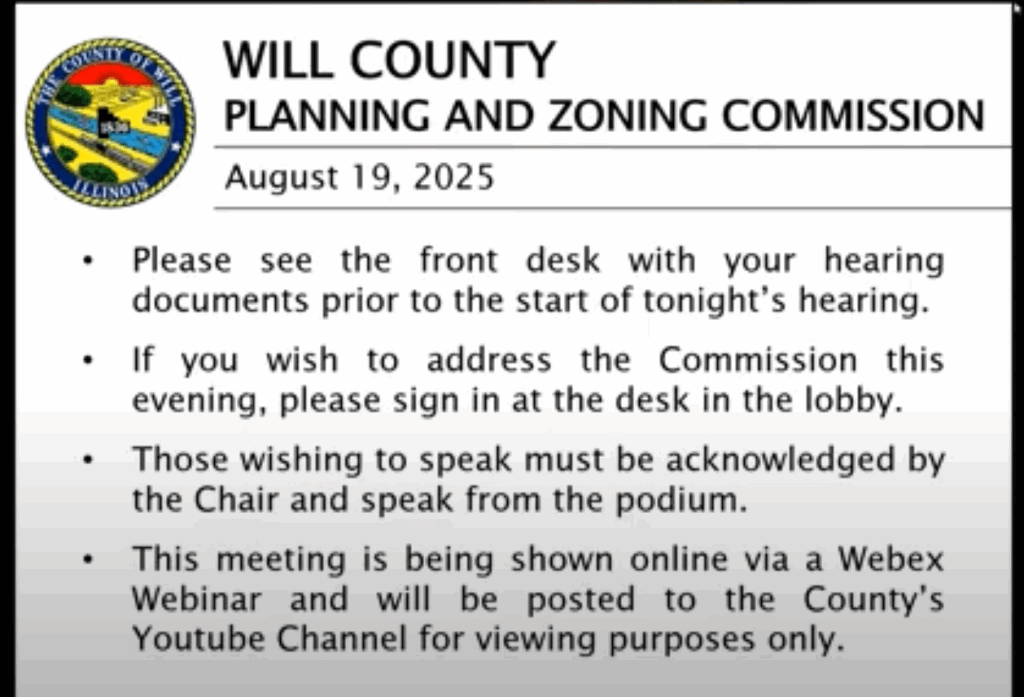

Will County P&Z: Washington Township Lot Variance Granted

Will County P&Z Approves Crete Solar Farm, Overruling Township’s General Opposition

Will County Board Approves Controversial Recovery Retreat in Crete Township Amid Strong Resident Opposition

Will County P&Z: Green Garden Township Variances Granted in Monee

Will County P&Z: Manhattan Township Rezoning Approved

Will County P&Z: Green Garden Township Rezoning Approved Amid Concerns Over Lack of a Final Plan

Zoning Commission Overrules Staff, Approves Greeen Garden Twp Variance for 3-Acre Agricultural Lot

Pritzker: Fair maps in Illinois would be ‘disarming’ to Democrats

State Overhauls Standardized Testing; Manhattan to Launch New Middle School Career Program

Meeting Summary and Briefs: Manhattan Village Board for August 19, 2025

Lincoln-Way Board Approves Special Education Co-op Budget Amid Concerns Over Rising Costs