Manhattan Fire District Approves $8.75 Million Bond Sale for New Fire Station

Manhattan Fire Protection District Meeting | September 15, 2025

Article Summary: The Manhattan Fire Protection District Board of Trustees has formally approved the sale of approximately $8.75 million in General Obligation Bonds to fund the construction and equipping of a new fire station. The district secured a favorable 4.13% interest rate following a competitive bidding process that attracted 48 bids.

New Fire Station Funding Key Points:

-

The board unanimously approved an ordinance to issue approximately $8.75 million in bonds.

-

The funds are designated for the construction and equipping of a new fire station, with foundation work set to begin next week.

-

After receiving 48 bids from seven underwriters, the bonds were sold to Baker Group at a 4.13% interest rate.

-

The district received an unmodified “clean” opinion on its latest financial audit, confirming its healthy financial position.

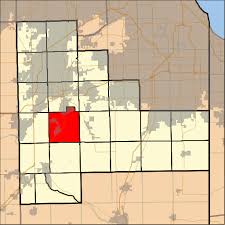

MANHATTAN, IL – The Manhattan Fire Protection District Board of Trustees on Monday, September 15, 2025, gave final approval to an ordinance authorizing the sale of approximately $8.75 million in General Obligation Bonds to finance a new fire station.

The unanimous vote paves the way for the district to lock in funding for the project, which is already moving forward. Fire Chief Steve Malone reported that foundation work and site utility installation for the new station are scheduled to begin next week.

Anthony Micelli of Speer Financial, the district’s financial advisor, presented the results of a competitive bond sale, explaining that the district’s strong financial standing attracted significant interest. “48 bids from 7 underwriters were received,” the meeting minutes noted. The final bid was awarded to Baker Group at a favorable interest rate of 4.13%. The closing for the bond sale is scheduled for October 7, at which point the rate will be locked in.

The district’s financial health was further confirmed earlier in the meeting with the presentation of its fiscal year 2024 audit. Monica Adaminski of the accounting firm Lauterbach & Amen reported that the district received an “unmodified opinion,” which she described as the cleanest possible outcome. Adaminski noted the district has a “very healthy year end balance” and sound pension funding.

In a related move to maximize its financial resources, the board voted to hire Sawyer Falduto Asset Management, LLC as its investment manager and to open an account with Schwab. The objective, according to the minutes, is to “earn as much interest as possible.”

The motion to approve ordinance 2025-03 for the bond sale was made by Trustee Larry Goodwin and seconded by Trustee Nick Kotchou, passing with a unanimous “AYE” vote from all trustees.

Latest News Stories

Plaintiffs take Cook County gun ban challenge to SCOTUS

Illinois quick hits: $1.57B return on investments; solar-powered manufacturer cuts ribbon

Report: Illinois U.S. Rep faces minimal penalty after disclosure violations

18 were injured, 2 killed in Minneapolis shooting

Trump HHS tells states to remove gender ideology from sex ed or lose PREP funding

Americans could face ‘sticker shock’ as once-small tax exemption ends

‘Pro-taxpayer’ law requires operators to clean up abandoned Illinois oil wells

Watch: Cook County gun ban plaintiffs petition SCOTUS; Pritzker hasn’t heard from White House

Illinois quick hits: Man on pretrial release accused of murder; holiday weekend impaired driving patrols

Illinois quick hits: Gun ban challengers petition SCOTUS; man sentenced for COVID fraud

WATCH: Trump: Illinois’ ‘slob of a governor’ should call for help with public safety

WATCH: Legislator says Illinois’ child welfare agency uses interns, has legal exposure