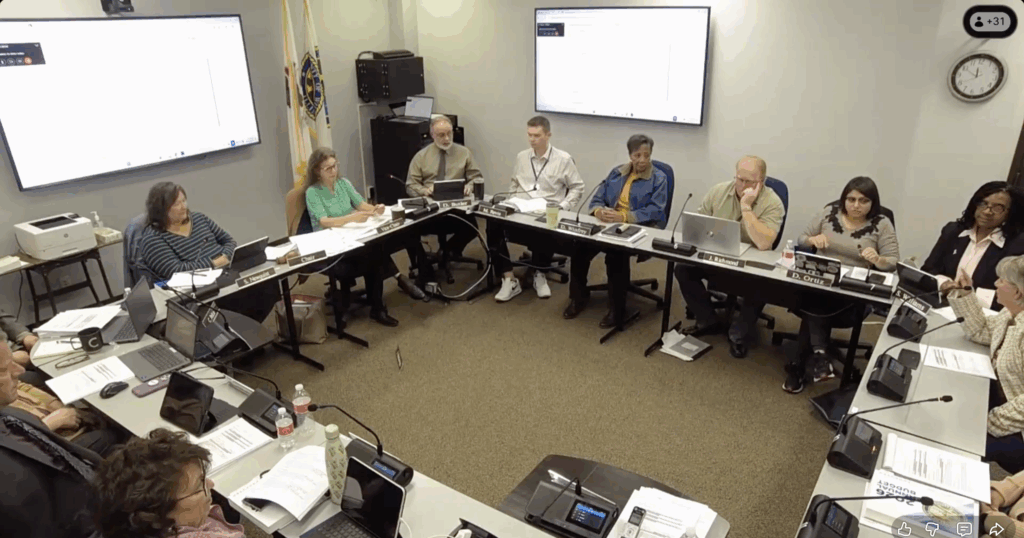

Manhattan School District 114 Approves $41.5 Million Budget for FY26

Article Summary: The Manhattan School District 114 Board of Education unanimously approved a fiscal year 2026 budget with $41.5 million in expenditures, a figure significantly influenced by the final costs associated with its major capital construction projects, including the new junior high school.

FY26 Budget Key Points:

-

The budget projects $31.5 million in revenue against $41.5 million in expenditures.

-

The nearly $10 million deficit is attributed to the completion of capital projects funded by previously issued bonds.

-

Local property taxes account for 68% of the district’s total revenue.

-

Salaries and employee benefits represent the largest expenditure categories.

MANHATTAN – The Manhattan School District 114 Board of Education gave its final approval Wednesday to a budget for the 2026 fiscal year that plans for $41.5 million in spending, driven largely by the conclusion of major building projects.

Following a brief public hearing where no comments were made, the board voted unanimously to adopt the budget. The plan anticipates total revenues of approximately $31.5 million, marking a 3.5% increase from the previous year.

During a presentation, Superintendent Dr. Damien Aherne explained that the large discrepancy between revenues and expenditures is a planned result of paying out the final costs for capital improvements.

“The discrepancy that you see between our revenues and expenditures are due to the capital project being complete,” Dr. Aherne said. He noted that the new district office project is about 99% finished and the district will soon wrap up all related expenses.

The district’s revenue is heavily reliant on local sources, with property taxes making up $21.5 million, or 68% of total income. State sources contribute about $9.3 million (30%), while federal funding provides approximately $650,000.

On the expenditure side, salaries remain the largest single cost at $14.7 million, accounting for 47% of revenues. Employee benefits total just over $4 million, or 13%. Another significant category is “Other Objects,” which at $16.1 million (39% of expenditures) includes interest payments on outstanding bonds, capital project costs, and special education tuition. Purchased services, which include transportation, insurance, and legal fees, are budgeted at $5.3 million.

Dr. Aherne noted that the final budget saw minor increases from the tentative version presented in August. The changes were primarily due to the settlement of contract negotiations, which clarified the actual costs for benefits, hourly wages, and stipends. “Our estimates were actually quite close in the tentative budget back in August,” he said.

The budget was on public display for over 30 days following the presentation of the tentative budget at the August board meeting, in accordance with state law.

Latest News Stories

JJC Advances ERP Modernization with New Vendor and Two-Year Budget

Will County Committee Shapes 2026 Legislative Agendas on Housing, Energy, and Health

JJC Authorizes Land Buy for Grundy County Expansion, Secures Site in Morris

Commission Grants Green Garden Solar Farm Project Variance Extension

Manhattan-Elwood Library Board Approves Annual Tax Levy

Manhattan Adopts Downtown Design Guidelines to Unify and Revitalize Village Center

Will County Committee Advances Phased Takeover of Central Will Dial-A-Ride Service

Manhattan Grapples with Route 52 Safety After Tragedy, Demands Action from IDOT

Manhattan Park District Ratifies Emergency Purchase of Bucket Truck for $36,500

Meeting Summary and Briefs: Will County Planning and Zoning Commission for October 21, 2025

Meeting Summary and Briefs: Will County Board Finance Committee for October 21, 2025

Crete Township ‘Tiny Home’ Owner Appeals Permit Denial