Small business leader warns swipe fees are squeezing local stores

A longtime small business advocate has launched a new website to help store owners explain credit card surcharges to their customers.

Karen Harned, who led the National Federation of Independent Business Small Business Legal Center for 20 years, launched Swipeflation.com to address the rising costs of credit card fees.

The site provides businesses with information to use at checkout, explaining why customers may see new fees when paying with credit cards.

“Most customers don’t realize that a percentage of every credit card purchase goes to big banks and card companies instead of the local store they’re trying to support,” Harned said in a news release. “If you want to help small businesses, or avoid these fees yourself, paying with cash is one way to do it.”

Eighty percent of consumers reported paying a credit card surcharge in the past year, according to a recent WalletHub survey.

Harned said small businesses aren’t profiting from these surcharges but are passing them along because of the 2% to 4% swipe fees that credit card companies charge on each transaction.

“Small businesses aren’t trying to nickel-and-dime anyone,” she said. “They’re simply being upfront about swipe fees so customers can decide whether to pay with a card or consider paying with cash.”

She said these costs are growing at the same time business owners are facing inflation and higher prices for supplies.

Ninety-two percent of small business owners report higher costs for supplies or services since 2020, and 71% said their costs have increased at least 20%, a Business.org survey found.

Credit card swipe fees nationwide exceeded $180 billion last year, according to industry data. That figure is up 70% from before the pandemic and equivalent to over $1,400 per household.

Harned said she hopes Swipeflation.com will help small businesses communicate more transparently with customers and raise awareness of the issue.

“No one wants an upset customer who is being asked to pay a fee to use their credit card,” she said. “What they want is to give them a better understanding of why they are asking, and how cash payments are a better alternative to keep the local merchant in business.”

Latest News Stories

Will County Grants Extensions to Five Solar Projects Sold to New Developers

Will County Board Approves Controversial Drug Recovery Retreat in Crete Township

Parents Voice Alarms Over Bus Safety, Lateness in Manhattan School District

Meeting Summary and Briefs: Village of Manhattan Board of Trustees for September 16, 2025

Joliet Junior College Honors Seven Long-Serving Employees Upon Retirement

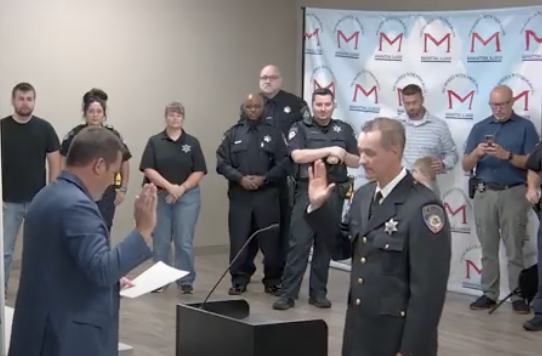

Manhattan Police Department Promotes Garrison to Commander, Diaz to Sergeant

Meeting Summary and Briefs: Manhattan Fire Protection District for August 18, 2025

Village of Manhattan Honors St. Joseph’s Catholic School on its 100th Anniversary

JJC Board Approves Contract with Adjunct Faculty Union

Manhattan Awards $547K Contract for US 52 Infrastructure Extension to Spur Growth

Fire District to Address Safety at High-Accident Intersections with County DOT

Meeting Summary and Briefs: Manhattan Township for August 2025